Find your path to retirement

Take a moment to visualize your retirement. Maybe you’re spending more time volunteering or enjoying your favourite hobbies. How old are you? Who else is there? Do you want to have enough savings to leave something for your loved ones, too?

Planning for your retirement can be exciting, but it’s also important to consider the more challenging questions, like:

- Can I afford to retire when I want, in the lifestyle I want?

- Do I have enough savings set aside for medical assistance or long-term care?

- Will my investments last through changing market conditions for as long as I need?

Start with what you have

Wherever and whenever you want to find yourself in retirement, you first need to figure out how to get there.

- Take stock of all your assets, including your investment portfolio and insurance policies.

- Find out how your group health, dental and life benefits will change when you stop working, and add the difference to your retirement expenses.

Plan your retirement income

Knowing how much you need to make your retirement plans work will guide your budget.

- Create a rough estimate of your future living expenses and income needs.

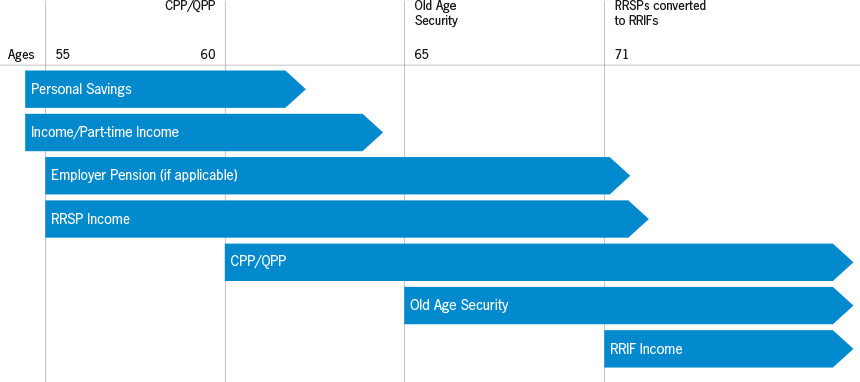

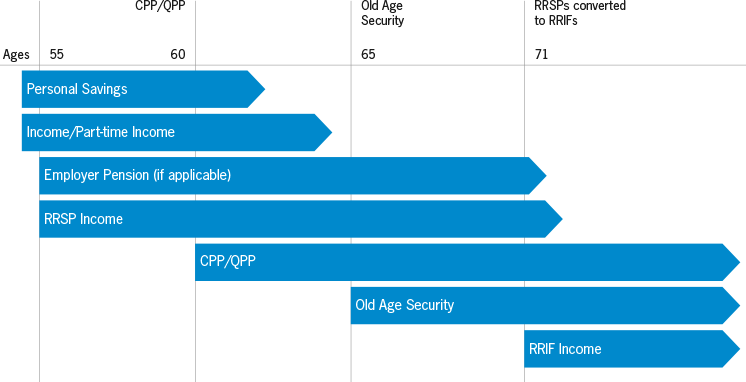

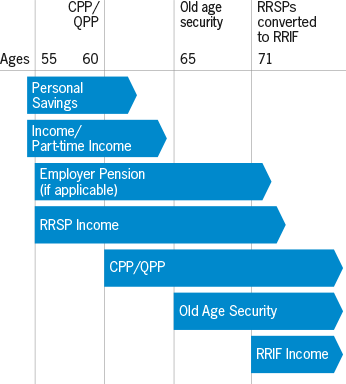

- Estimate how much income you’ll receive from government benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS), company-sponsored pension plans, and your own investments.

- Find out how to convert assets held within your registered plans, such as your RRSP, to retirement income.

Make sure you’re clear on what funds you can access at the age you decide to retire.

Create a safety net with life insurance

While you’re calculating your retirement income, it’s important to review your life insurance plan as well. If your spouse were to pass away during your retirement, then your company pension, CPP and OAS could be reduced.

Know your retirement income options

No single product can address every retirement challenge, so build your portfolio with a mix of retirement income products.

- Scheduled Withdrawal Plan (SWP): An extension of your non-registered and TFSA plans, you can use an SWP to turn your savings into an income payment.

- Registered Retirement Income Fund (RRIF): An extension of your RRSP, you can use your RRIF to withdraw income during retirement.

- Life Income Fund (LIF): Similar to a RRIF, LIFs are designed specifically for locked-in pension funds. LIFs are only available in certain provinces.

- Annuities: Provide you with a regular, fixed-income payment for life or a set term of your choice, usually paid monthly.